Real estate marketing collateral designs by Isagodoy91 Fiverr

Collateral is a thing of value that a borrower can pledge to a lender to get a loan or line of credit; common examples of collateral include real estate, vehicles, cash and investments.

Using Real Estate as Collateral All City Bail Bonds

This type of collateral is a legal claim on all assets on the premises of the property (like construction equipment or fixtures) that can be repossessed should payments fall behind. First security interest allows the lender to sell any repossessed items as collateral to pay off the loan. Personal Guarantee

Real Estate as collateral Second,

A collateral loan is a secured loan that requires the borrower to provide an asset as security for repayment. With these loans, a lender can take possession of your property—the loan.

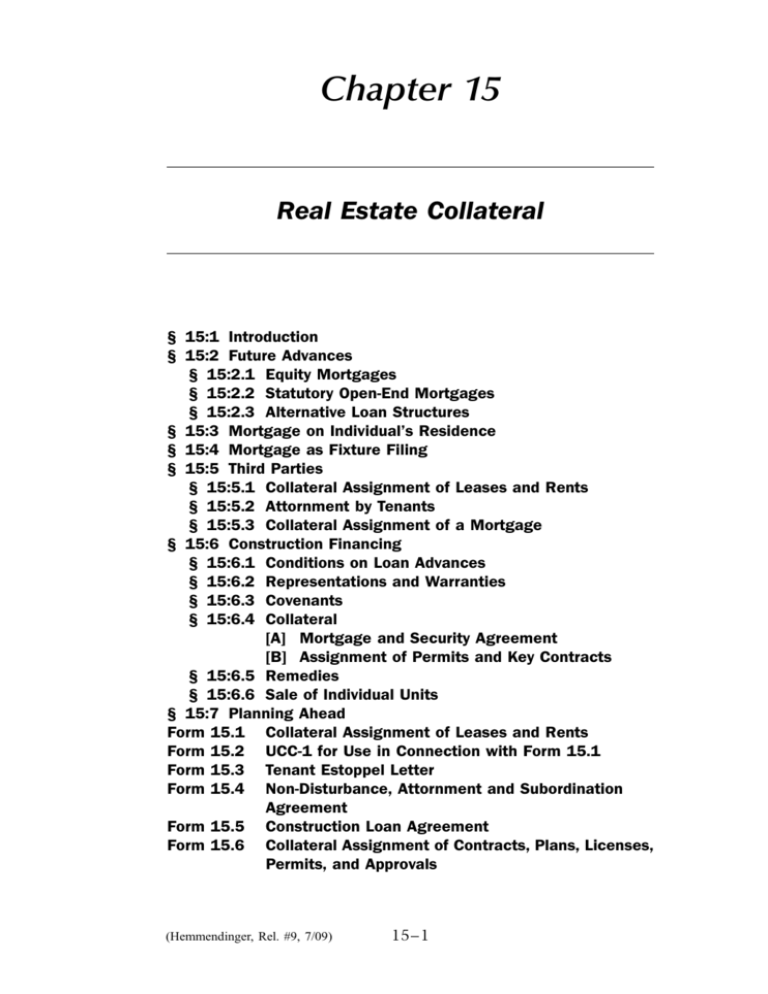

Understanding different types of real estate collateral

Real estate, including residential and commercial property, is frequently used as collateral for loans to protect lenders if a borrower defaults.Homeowners can benefit from real estate equity loans, businesses can expand their operations through real estate lending and rentals, and investors can earn up to 15% interest annually.

Understanding different types of real estate collateral

Collateral loans on property are backed by the real estate that you are financing. If you miss payments, the loan can go into default, in which case the lender forecloses on your home and.

Commercial Real Estate Loan How To Use Collateral And

Real estate, including homes and commercial property, is commonly used as collateral for loans. Lenders often require collateral to protect themselves in case the borrower defaults, lending a percentage of the dollar value of the asset securing the loan.

Real Estate Collateral Loans A Complete Guide for Borrowers Tasteful Space

Asset based lending (ABL) is the practice providing a business financing based upon monetizing the company's balance sheet. If a company has assets such as accounts receivables, real estate, inventory, equipment and machinery, they can use them as collateral to obtain financing. The most common facility used for asset based financing is a.

Real Estate Collateral

In real estate, collateral is a tool that diminishes one's risk in a transaction. It's about having something of value that belongs to the other party to "motivate" them to abide by the set rules. Let's discuss the real estate collateral definition a little further.

Real Estate Collateral Mike Youtz, Design Professional

] What Is A Real Estate Investor Line Of Credit? A real estate investor line of credit is a financing option that allows investors to tap into a property's equity, much like a business credit card. An investor line of credit is a relatively simple concept and provides investors with quick access to cash.

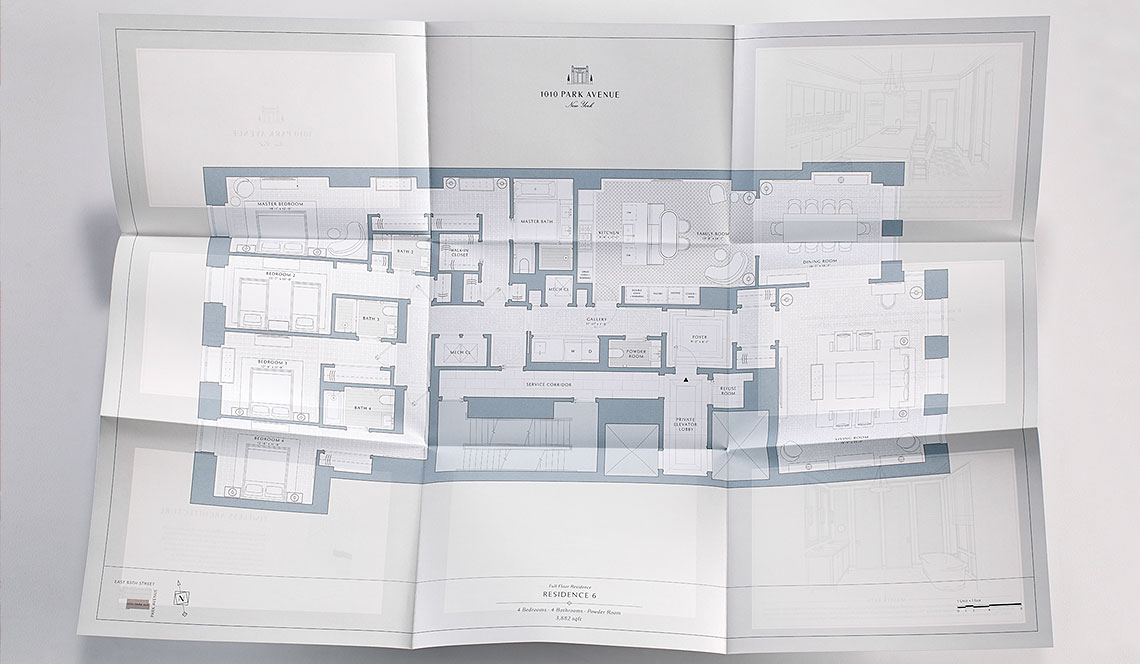

Distinctive Real Estate Collateral for NoMad Residences Fine Commercial Printing, NYC, NJ, CT

What is Real Estate Collateral? Usually, Real Estate is seen as the most prominent and commonly collateral while investing in the real estate market. Going a step further, property ownership can be one of the best Real Estate Collateral attached to your investments.

Distinctive Real Estate Collateral for NoMad Residences Fine Commercial Printing, NYC, NJ, CT

Real estate collateral is any personal property used to guarantee a mortgage loan. Typically a property used in real estate collateral loans could include buildings, factories, warehouses or even shopping malls - all of which are generally considered safer investments that have value and typically do not depreciate quickly.

Types of Real Estate Collateral You Need to Understand Before Investing

Collateral refers to an asset that a borrower offers as a guarantee for a loan or debt. For a mortgage (or a deed of trust, exclusively used in some states), the collateral is almost always the.

Real Estate Print Collateral Real Estate Branding Series RealestateMY

A Realtor.com coordinator will call you shortly What's next A coordinator will ask a few questions about your home buying or selling needs. You'll be introduced to an agent from our real.

Understanding different types of real estate collateral

Collateral is an item of value pledged to secure a loan. Collateral reduces the risk for lenders. If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup.

Real Estate Collateral Near You Printing in NYC, NJ, LI Fine Printing by Fine Commercial

Collaterals are some types of assets accepted by lenders and act as security for the borrowed amount. Some common types of assets include real estate, investments, gold, vehicles, and much more. These assets provide security to the lenders against potential defaults. If the borrower defaults on the repayment, the lender can repossess the.

What is Collateral Substitution in Real Estate? YouTube

A collateral loan is a debt the borrower takes on by providing an asset to guarantee repayment. Also called a secured loan, a collateral loan requires the borrower to offer an asset to assure the lender of the borrower's intent to pay the loan in full. If the borrower fails to repay the loan, the lender has the right to take the asset as.